Commentaries

Trends We're Tracking: Cooling Inflation, AI, and Value's Return

Envestnet | PMC provides independent advisors, broker-dealers, and institutional investors with comprehensive manager research, portfolio consulting, and portfolio management to help improve client outcomes. Every month our Global Macro Team offers insights into the themes currently shaping the markets to help you quickly take note of recent trends that your clients may be inquiring about.

Unpacking cooling inflation

Surging inflation and the monetary policy response to it were leading drivers of market volatility and losses amongst equities and fixed income in 2022. In recent months, there has been a general cooling of headline inflation data, with the November Consumer Price Index (CPI) reading of 7.1% year-over-year, down from a peak inflation read of 9.1% in June. November’s reading marks the lowest annual reading since December 2021, finally providing some breathing room to consumers.1 However, the overall price increase we’ve experienced is likely stickier than the broad data’s decline indicates. Unpacking inflation a bit further provides mixed results as several items continue to push the spike while others drive the cooling.

Visit here to read further analysis on this topic.

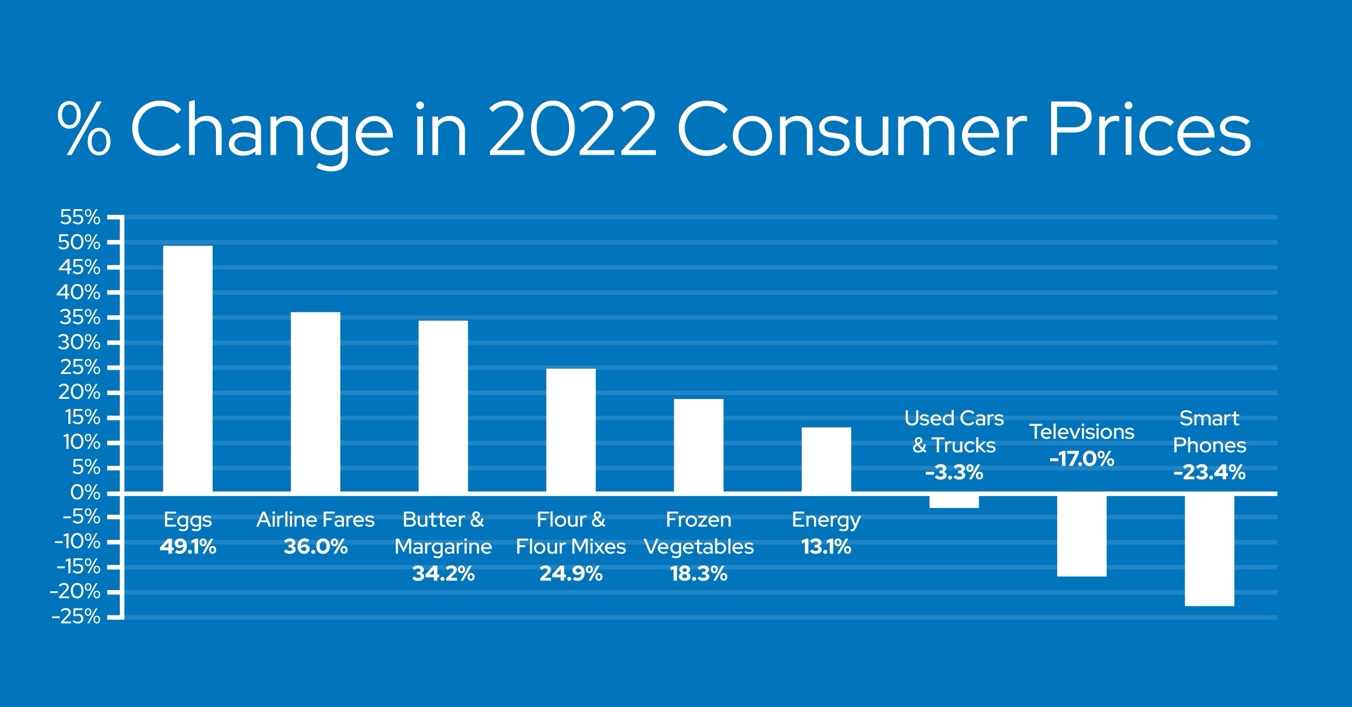

Eggs, airline fares, butter/margarine, flour, and frozen vegetables are several of the items with substantially elevated readings over the trailing 12 months, through November, with increases of 49.1%, 36.0%, 34.2%, and 24.9%, respectively. Price increases on these items continue to burden consumers. Energy prices were up 13.1% over the past 12 months, but did decline in November, falling 1.6% for the month. Core CPI, which removes the volatile food and energy components, rose 6.0% year-over-year.

Used cars and trucks, which was one of the highest surging components in the inflation spike, fell 2.9% for the month of November, and is now down 3.3% from a year ago. Televisions and smartphones are two items experiencing substantial declines on the index, dropping -17.0% and -23.4%, respectively. While not items that are experiencing deflation, televisions and smartphones have improved their quality, which has led to adjustments.2 Even as inflation has cooled, it remains substantially above the Fed’s 2% target, which may lead to further tightening and a tougher road ahead for the global economy in 2023.

On the day following the November CPI release, December 14, the Federal Reserve concluded its two-day FOMC meeting, announcing a 50 basis points increase in the fed funds rate, bringing the key rate to a range of 4.25 to 4.50%. The 50 basis point hike was a shift from the four consecutive 75 basis point increases this year, the most aggressive monetary tightening since the early 1980s, as the central bank continues to combat high inflation. While the Fed slowed the pace of its hikes, its overall tone remained hawkish, with Fed Chair Powell stating, “it will take substantially more evidence to give [us] confidence that inflation is on a sustained downward path.”3

After 425 basis points of rate hikes in 2022, what does the Fed have in store for 2023? The FOMC dot plot from December indicated a continuation in rate increases, with an expected terminal rate of 5.1% in 2023, which is higher than the 4.6% terminal rate projected by the Fed in September. It is likely that rate hikes will continue, but in a less aggressive manner. Traders are currently pricing in a rise to nearly 5.00% on Fed Funds Futures by mid-year, but also see a move back towards 4.50% before the end of 2023, with the market seeing a Fed pivot despite its current hawkishness. All eyes will be on the inflation data release in mid-January as well as the results of the FOMC two-day meeting concluding February 1. Will inflation continue its cooling trend? And does this give the Fed room to pause tightening in 2023?

Source: U.S. Bureau of Labor Statistics

https://www.bls.gov/charts/consumer-price-index/consumer-price-index-by-category-line-chart.htm

Source: U.S. Bureau of Labor Statistics - https://www.bls.gov/cpi/

Artificial Intelligence and ChatGPT

2022 was a challenging year for the technology sector, with many of the major companies taking cost cutting measures and laying off thousands of employees in the face of a tightening economic environment and falling corporate valuations. Despite the difficult environment, we saw major developments, particularly with advancements in artificial intelligence (AI), and most notably, the release of ChatGPT at the end of November. ChatGPT is a conversational AI tool that can respond to wide range of user requests, such as writing computer code, solving complex math problems, and generating original content like song lyrics and movie scripts. ChatGPT is different from online search engines as it isn’t looking anything up, but rather its output is the AI’s best approximation of the answer based on its knowledge base. This new technology has received massive interest, hitting over 1 million users in 5 days, faster than any previous app.4 While ChatGPT has received high praise, there are still many concerns about data accuracy and privacy, making many wonder how much of this technology is hype vs. reality.

Value’s return

Over the last full market cycle, from July 2007 to December 2021, the Russell 1000 Growth Index outperformed the Russell 1000 Value Index by 6.3% on an annualized basis. During this period of low interest rates, the FAANG (Facebook, Apple, Amazon, Netflix, and Google) stocks dominated on the back of cheap capital, as investors sought higher returns than what bonds or safer investments offered. Over the past year, the story has changed. In 2022, while interest rates increased at a historic pace, value turned the tide and outperformed. The Russell 1000 Value Index outperformed the Russell 1000 Growth Index by 21.6%, as many of the highest-flying stocks over the last decade were punished.5

Sources:

1. Molly Smith and Augusta Saraiva, “US Inflation Relief Is Finally Happening, Putting Fed Pause in View,” Bloomberg, December 13, 2022, https://www.bloomberg.com/news/articles/2022-12-13/us-inflation-relief-is-finally-happening?leadSource=uverify%20wall

2. Jeanna Smialek, “Inflation Cooled Notably in November, Good News for the Fed,” The New York Times, December 13, 2022, https://www.nytimes.com/2022/12/13/business/economy/inflation-cpi-november.html

3. U.S. Bureau of Labor Statistics - https://www.bls.gov/cpi/

4. Dalvin Brown and Ann-Marie Alcántara, “ChatGPT and Lensa: Why Everyone Is Playing With Artificial Intelligence,” The Wall Street Journal, December 7, 2022, https://www.wsj.com/articles/everyone-in-your-feed-is-talking-about-chatgpt-and-lensa-and-heres-why-11670356499?mod=Searchresults_pos2&page=1

5. “The Five Financial Trends that 2022 Killed,” The Economist, December 21, 2022, https://www.economist.com/finance-and-economics/2022/12/21/five-financial-trends-that-2022-killed

The information, analysis, and opinions expressed herein are for general and educational purposes only. Nothing contained in this brochure is intended to constitute legal, tax, accounting, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type. All investments carry a certain risk, and there is no assurance that an investment will provide positive performance over any period of time. An investor may experience loss of principal. The asset classes and/or investment strategies described may not be suitable for all investors and investors should consult with an investment advisor to determine the appropriate investment strategy. Investment decisions should always be made based on the investor’s specific financial needs and objectives, goals, time horizon and risk tolerance. Past performance is not indicative of future results. This material is not meant as a recommendation or endorsement of any specific security or strategy. Information has been obtained from sources believed to be reliable, however, Envestnet | PMC cannot guarantee the accuracy of the information provided. The information, analysis and opinions expressed herein reflect our judgment as of the date of writing and are subject to change at any time without notice. An individual’s situation may vary; therefore, the information provided above should be relied upon only when coordinated with individual professional advice. Reliance upon any information is at the individual’s sole discretion. Diversification does not guarantee profit or protect against loss in declining markets.

FOR INVESTMENT PROFESSIONAL USE ONLY ©2023 Envestnet. All rights reserved.