Quantitative Research

Capital Sigma: The Advisor Advantage

As conversations around fees and value continue to unfold, how can advisors help their clients better understand what they can expect for the dollars they pay? Whether advisors are looking to build deeper relationships with existing clients or preparing to take their practice to the next level, we believe there is no better time to explore opportunities to enhance the value delivered.

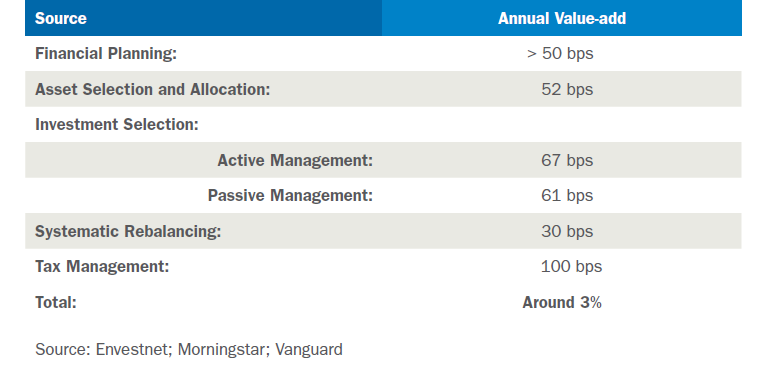

We recently updated our quantitative research study, “Capital Sigma: The Advisor Advantage,” which explores how select sources of advisor-created value can produce meaningful levels of excess return. For advisors to deliver the most alpha to client portfolios, we recommend a focus on five sources: financial planning, asset selection and allocation, investment selection, systematic rebalancing and tax management. The sum total of these five sources creates what we call Capital Sigma. In fact, the combination of successfully implementing these five sources has produced around 3% of value add annually—results that are consistent with PMC research first published in 2014.

Here are the five components of advisor-created value and action steps for how advisors can integrate them into their practices:

1. Build lifetime relationships around a comprehensive planning approach

Financial planning is the leading source of advisor alpha, as it establishes the framework for each subsequent fiduciary decision made by advisors and their clients. Our research finds that asset location advice alone contributes about 50 basis points of excess return annually. When advisors start with a deep dive into understanding a client’s most important priorities, they can create a comprehensive roadmap to address short- and long-term goals.

As part of financial planning, advisors should focus their attention on:

- Assessing a client’s tolerance for all dimensions of risk

- Tax planning advice, including asset location strategies and retirement account structures

- Insurance planning that weighs a client’s needs in the context of the entire financial picture

- Retirement planning that integrates cash flow needs, health care, long-term care coverage and more

- Estate planning that helps a client pass on wealth in the most efficient way and create a legacy that spans generations

2. Craft asset class selection and allocation to achieve client goals

Both academic and industry research often highlight the importance of asset class selection and allocation decisions.1 Our research concurs: a thoughtfully developed asset allocation that is both diversified and consistent with a client’s risk profile and investment objectives can add 52 basis points of value annually.2

Molding a suitable asset allocation harnesses both diversification and exposure to a range of investment that can deliver value across a complete market cycle. We also advocate supplementing Modern Portfolio Theory with other risk-mitigating strategies, such as tactical overlays, liquid alternatives and liquid endowment portfolios.

3. Design customized investment solutions that align with client objectives

Customized investment selection is a critical component of the value advisors deliver to clients. Whether the overall implementation approach should seek alpha through selecting active managers or by choosing passive investment options will depend on a client’s individual objectives. Our research finds that employing a strategy of selecting active mutual fund managers can add 67 basis points of value annually, while a passive strategy can add 61 basis points.

4. Put systematic portfolio rebalancing to work

Systematically rebalancing a diversified portfolio should be carried out every year rather than the naïve approach of rebalancing once every three years. We believe two key benefits arise from a carefully constructed and systematic rebalancing policy: greater risk control and enhanced returns. This fourth step can add 30 basis points of value each year.

5. Focus on tax management

Because efficient tax management in an all-equity portfolio can add approximately 100 basis points of value annually, it’s a component of advisor-added value that simply can’t be ignored. We recommend a tax optimization approach that defers the realization of gains, manages the holding period of assets and harvests losses while ensuring the portfolio follows its risk and return targets.

Learn more

For more on our updated research study, “Capital Sigma: The Advisor Advantage,” read the full report. As Envestnet’s portfolio consulting group, Envestnet | PMC is the ultimate advisor to the advisor. We provide advisors with all the experience and solutions they need – from comprehensive manager research to portfolio consulting and portfolio management – to help improve client outcomes.

Footnotes

1.Gary P. Brinson, L. Randolph Hood, and Gilbert L. Beebower (1986). “Determinants of Portfolios Performance,” Financial Analysts Journal, v.42(4), pp.39-44.

2. In the previous update of this white paper, which was done in 2014, we used the Russell 3000 Index as the benchmark for this calculation. Since then, international equity asset classes have become staples in well-diversified portfolios. This broad change in the way the international equity asset class is viewed then necessitates a change in the benchmark against which the asset class selection and allocation decisions are measured. To capture this correctly, we use the MSCI ACWI benchmark in this version of the paper, instead of the Russell 3000 Index. For completeness, had we used MSCI ACWI benchmark in our 2014 version of this paper, the Asset Class Selection and Allocation and Systematic Rebalancing components of Capital Sigma would have been equal to 63 and 39 basis points, respectively.

Disclosure:

The Russell 1000 Index measures the performance of the largest 1000 U.S. companies in the Russell 3000 Index representing approximately 92% of the investable U.S. equity market.

The Russell 3000 Index measures the performance of the largest 3000 U.S. companies representing approximately 98% of the investable U.S. equity market.

The Barclays US Aggregate Bond Index is a market capitalization-weighted index of investment-grade, fixed-rate debt issues, including government, corporate, asset- backed, and mortgage-backed securities, with maturities of at least one year.

The information, analysis, and opinions expressed herein are for general and educational purposes only. Nothing contained in this document is intended to constitute legal, tax, accounting, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type. All investments carry a certain risk, and there is no assurance that an investment will provide positive performance over any period of time. An investor may experience loss of principal. Investment decisions should always be made based on the investors’ specific financial needs and objectives, goals, time horizon, and risk tolerance. The asset classes and/or investment strategies described may not be suitable for all investors and investors should consult with an investment advisor to determine the appropriate investment strategy. Past performance is not indicative of future results.