Commentaries

ETF Model Portfolios: Gaining Traction and Market Share

Advisors are increasingly choosing Exchange-Traded Fund (ETF) model portfolios for their clients, according to Envestnet data. Let’s explore this trend and the forces driving it.

For the past several months, we’ve discussed ETFs and their unique attributes. We’ve explored ETF basics, the structure of these funds, innovation in active ETFs, and active ETF tax efficiency. As we conclude this introductory series of ETF articles, it’s time to broaden our horizons and examine ETF use in portfolios. Specifically, we’ll delve into the growing use of ETF third-party model portfolios by financial advisors. Since model portfolios and ETFs are becoming increasingly popular with advisors, it’s no surprise that the combination of these products represents a major industry trend.

A Word on Third-Party Model Portfolios

Third-party model portfolios—also known as strategist portfolios, asset allocation models, asset allocation model portfolios, or Fund Strategist Portfolios in Envestnet parlance—have witnessed a surge in advisor adoption. These solutions are now regularly being implemented as core components of financial advisory practices. Advisors choose to integrate their practices with these strategist models for several reasons—the desire for comprehensive total portfolio solutions, access to institutional asset allocation, due diligence, and risk management expertise, low-cost portfolio management, and transparency. The efficiency gained by outsourcing portfolio construction and monitoring enables advisors to focus on serving their existing clients while potentially tapping into fresh business development opportunities.

ETF Portfolio Construction

In a portfolio construction context, ETFs may make sense due to trading convenience (essential to portfolio rebalancing!), generally low fees, tax efficiency, and their lack of minimum investment requirements. The breadth of ETF product offerings also enables these funds to serve as the building blocks of both strategic and tactical allocations. A strategic allocation strategy could utilize a handful of ETFs to build a diversified portfolio for long-term investment. Meanwhile, a tactical portfolio manager might use ETFs with niche, sector, or thematic exposures to make shorter-term bets. Model portfolio managers—in addition to advisors and home offices that build portfolios in-house—have taken note of these ETF features and built portfolios utilizing them.

ETF portfolios can be built using only passively-managed funds, only actively-managed funds, or a mixture of both. Model portfolio providers may also develop multiple series of portfolios to satisfy a range of investor needs and advisor preferences. The many “flavors“ of ETFs support flexibility and open-architecture model development. Envestnet platform data also indicate that financial advisors have a preference for model portfolios without an explicit manager fee1, so many asset managers are now creating models that utilize their own ETFs. The models’ underlying ETF expense ratios compensate these asset managers without them tacking on another layer of fees.

Momentum in ETF Model Portfolio Adoption

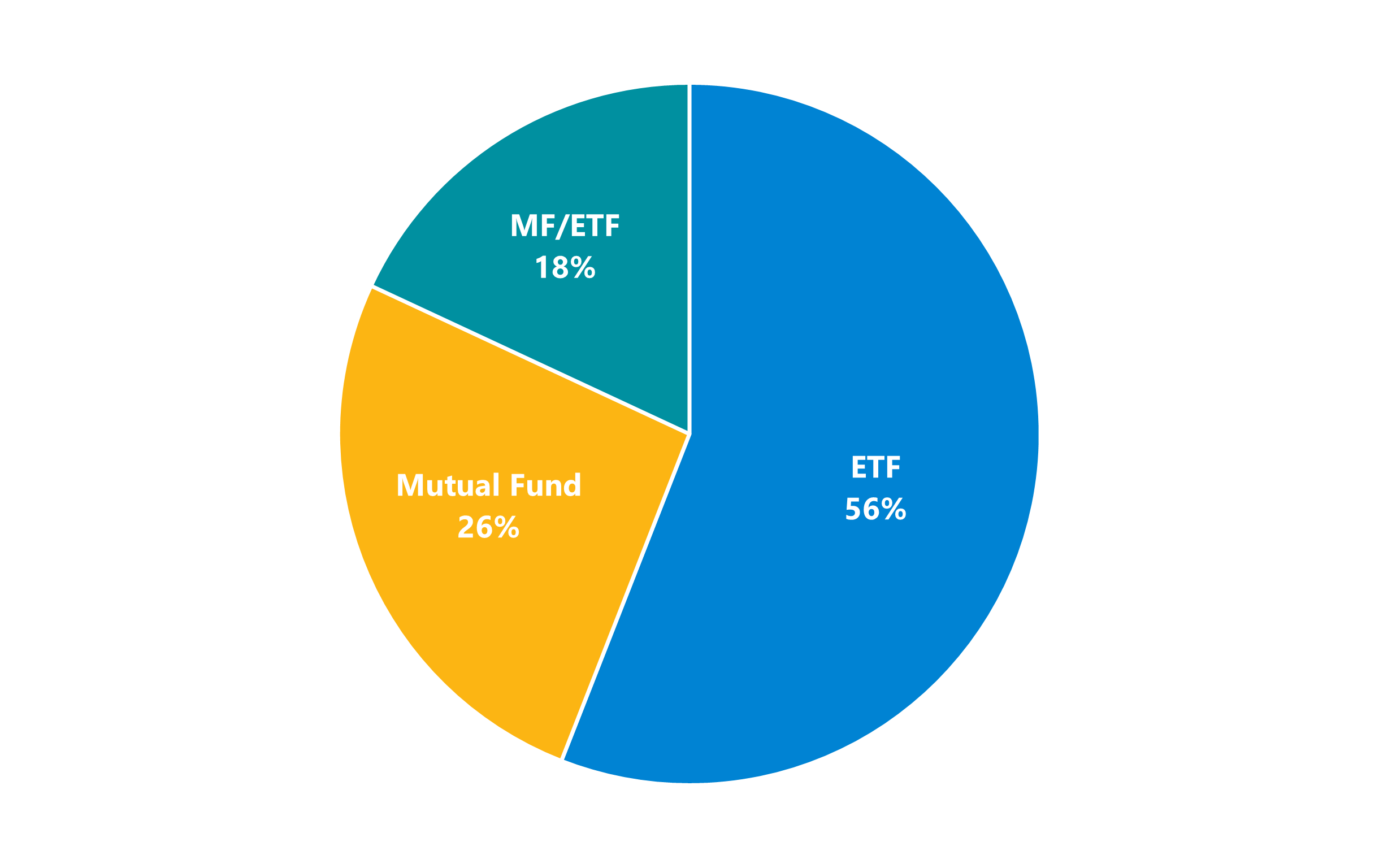

According to data from Envestnet Analytics, ETF model portfolios on our platform gathered over half of third-party model inflows over the past two years. Specifically, 56% of these inflows went to ETF-only portfolios, more than double the percentage of flows into mutual fund model portfolios. 18% of inflows went to models using both mutual funds and ETFs, too.

Breakdown of Third-Party Model Portfolio Inflows by Model Type2

Final Thoughts

ETF model portfolio utilization continues to steadily expand, and we believe this trend is likely to continue. The overall growth of third-party model portfolio assets and the increasing flows into ETFs represent two major shifts in the industry; these changes are actually reinforcing each other. ETFs can simplify and enhance model portfolio construction while third-party models enable advisors to easily allocate money to ETFs. In short, these investment products may be better together. We’ll continue to follow developments in the ETF and model portfolio product categories, too. As always, please reach out to us with any questions!

Sources:

1Envestnet Analytics.

2Envestnet Analytics. 24-month flows as of June 30, 2023. Data includes only broadly distributed FSP assets.

The information, analysis, and opinions expressed herein are for informational purposes only and represent the views of the speakers, not necessarily the views of Envestnet. The views expressed herein reflect the judgement of the writer and are subject to change at any time without notice. Information obtained from third party resources are believed to be reliable but not guaranteed. Any graphical information contained herein is for illustrative purposes only and not based on actual client data.

Exchange Traded Funds (ETFs) and mutual funds are subject to risks similar to those of stocks, such as market risk. Investing in ETFs may bear indirect fees and expenses charged by ETFs in addition to its direct fees and expenses, as well as indirectly bearing the principal risks of those ETFs. Income (bond) ETFs and mutual funds are subject to interest rate risk which is the risk that debt securities in a fund´s portfolio will decline in value because of increases in market interest rates.

Expense Ratios reflect the internal expenses of any investment products but do not reflect the deduction of investment advisory fees. Performance results will be reduced by fees including, but not limited to, investment management fees and other costs such as custodial, reporting, evaluation and advisory services. A description of all fees, costs and expenses are found in a financial advisor's Disclosure Brochure. Past performance is not indicative of future results.

Neither Envestnet, Envestnet | PMC™ nor its representatives render tax, accounting or legal advice. Any tax statements contained herein are not intended or written to be used, and cannot be used, for the purpose of avoiding U.S. federal, state, or local tax penalties. Taxpayers should always seek advice based on their own particular circumstances from an independent tax advisor.