Commentaries

Do Active ETFs Deliver on Tax Efficiency?

Active ETFs can offer significant tax reductions, on average, versus active mutual funds in three of the four categories we examine. Active ETFs may provide direct cost savings, too.

In the previous article of this series, we introduced you to the world of active ETFs and the features of these funds. Although we referenced the potential tax benefits of using active ETFs instead of traditional mutual funds in our earlier post, this aspect of active ETFs deserves greater attention. (One reader even wrote to request more research on the topic!) While the tax efficiency of passive ETFs has been addressed in multiple industry reports and academic papers, there’s a dearth of information on active ETF taxation. We’re here to fill this gap in the tax data while also quantifying the differences in active ETF and mutual fund expense ratios across four key asset classes. Let’s explore our findings!1

Active ETFs Can Reduce Tax Drags

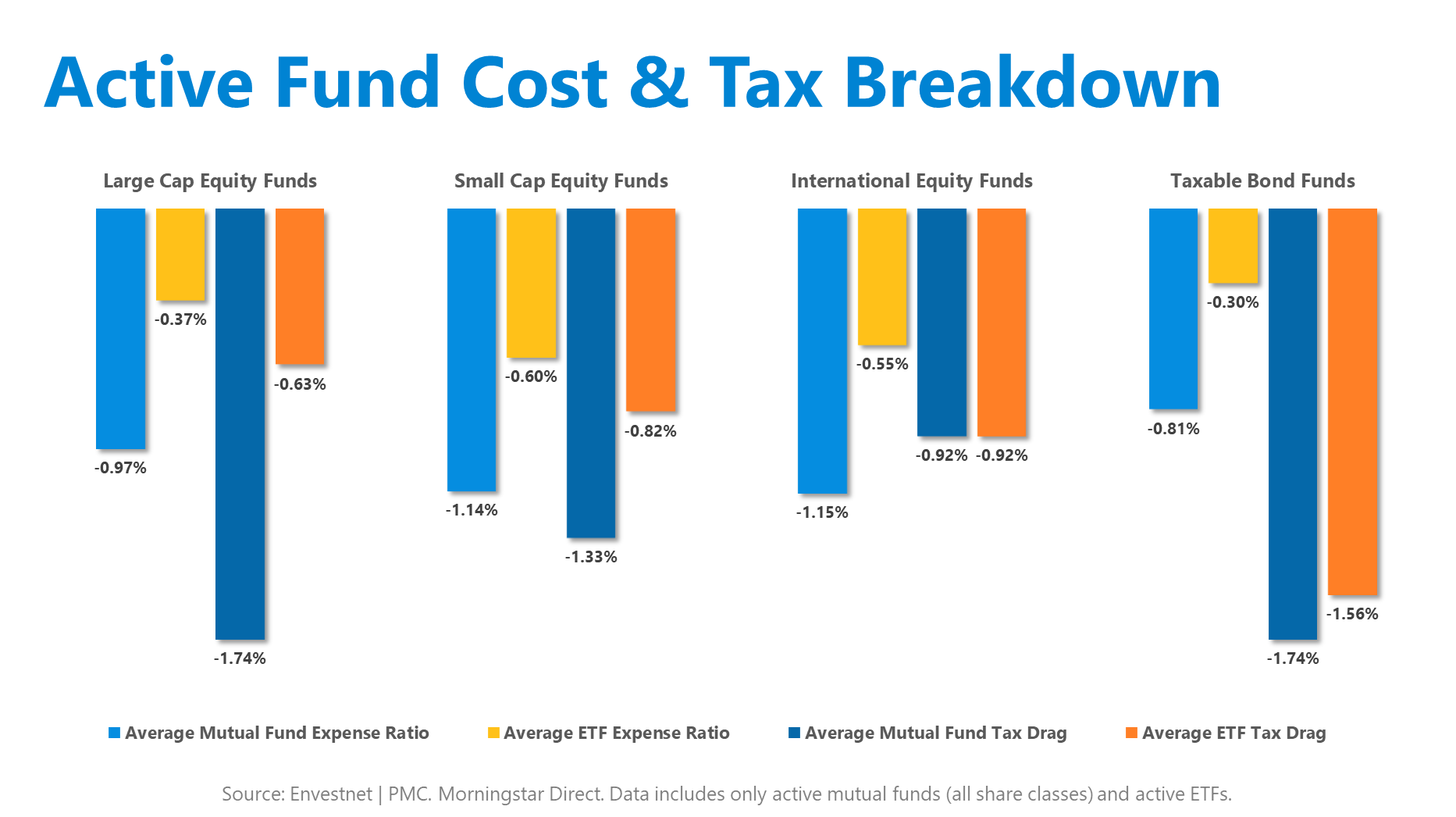

We used the Morningstar Tax Ratio data set to model tax drags on funds. This metric assesses the difference between pre-tax and after-tax returns. For our analysis, we used one-year tax drag data for funds because one of the most popular structures for active ETFs only received SEC approval in 2019, with launches beginning in 2020.2 For that reason, three-year tax drag data isn’t available for many active ETFs. Expense ratios for all funds were pulled from their most recent prospectuses. We narrowed the fund universe to include only US products denominated in US dollars, too. Our results are summarized in the visual below:

As you can see, active ETFs offer significantly greater tax efficiency than actively-managed mutual funds in three of the four asset classes we investigated. The results are especially dramatic for large and small cap equity funds where active ETFs deliver the largest reductions in taxes. Meanwhile, the taxable bond asset class is notoriously inefficient due to interest payments (which is why these funds may be placed in tax-advantaged accounts), but bond ETFs still deliver lower tax drags than fixed income mutual funds.

Now let’s turn to the International Equity asset class where ETFs and mutual funds had equivalent tax drags. For mutual funds, this was the most tax-efficient asset class we studied. On the active ETF side, there was a tiny number of active International Equity products to analyze. One incredibly tax-inefficient active ETF skewed the result for this asset class higher due to the small sample size. Excluding that one fund, the average tax drag for active ETFs would be slightly lower than for mutual funds.

A Word on Expenses

In addition to the tax savings that active ETFs can provide, they also carry lower expense ratios, on average, than active mutual funds. The cost reduction is pervasive across all four of the asset classes we researched, and the fee differentials are quite large. These direct savings benefit investors in tax-advantaged accounts and across tax brackets, too. For these reasons, the lower fees associated with active ETFs are arguably even more important than the tax efficiency.

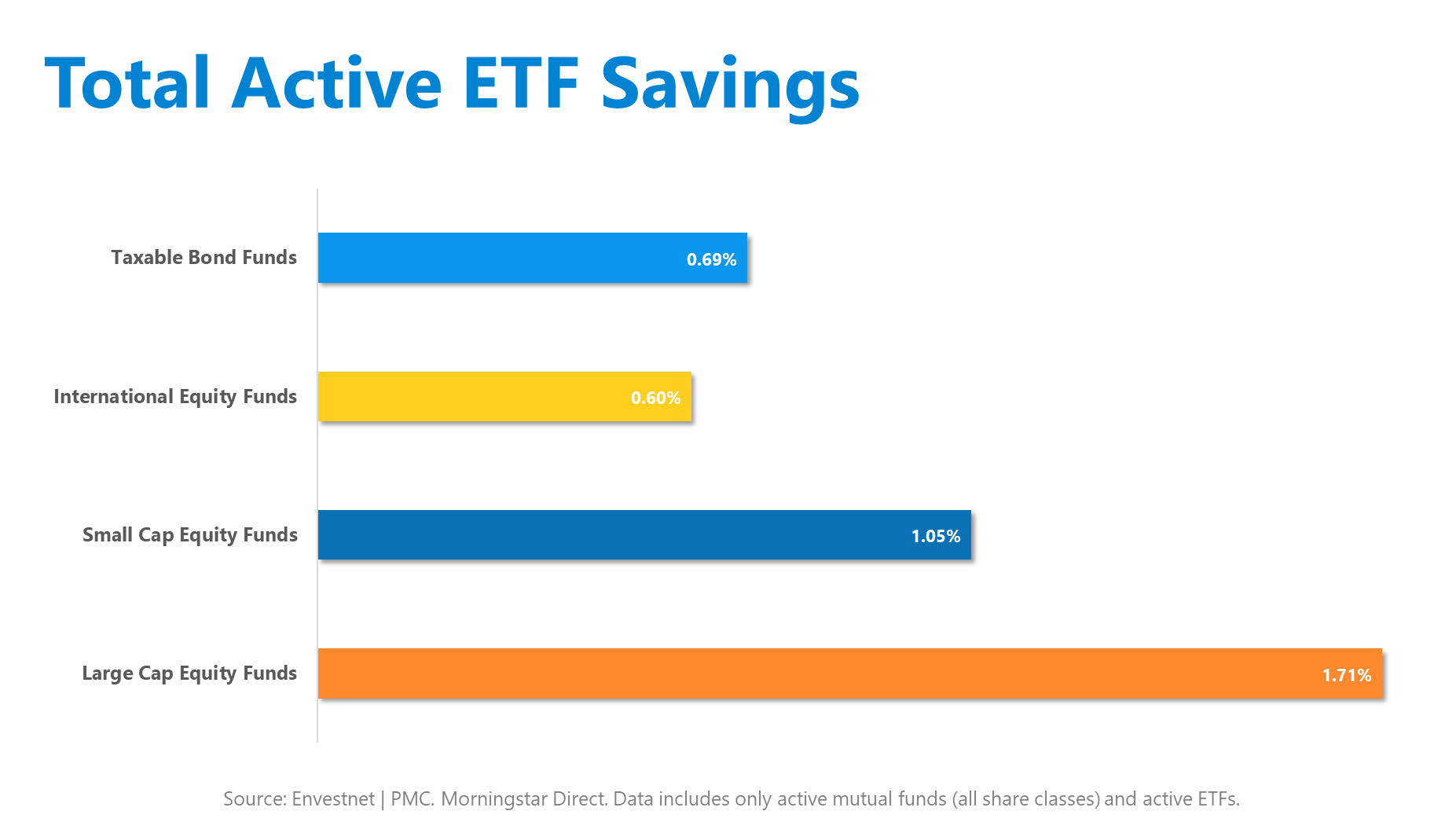

Combined Savings

We decided to combine the average reduction in tax drags and fees offered by active ETFs when compared with active mutual funds. This unified analysis helps illuminate the comprehensive savings that may be received by using active ETFs instead of mutual funds. While the range of tax and cost reductions varies across asset classes, the results are clear: Performance drags can potentially be lowered by using ETFs, especially in taxable accounts.

Wrapping Up

In summary, active ETFs can provide meaningful tax and fee savings for investors, but it’s important to remember that expenses and tax efficiency vary widely across the product universe. ETFs and mutual funds exhibit significant cost differences, even among products that seem very similar. It’s worth noting, however, that ETFs don’t have the multiple share classes, sales loads, and breakpoints that complicate mutual fund cost analysis. Comparing the tax efficiency of various funds can be quite challenging, though, so we welcome your outreach if you’re an advisor who’d like research assistance or information on ETF portfolios. We’re always happy to help, and, speaking of ETF portfolios, they will be the topic of our next article in this series! We look forward to sharing more ETF research with you soon.

Sources:

1All data sets are from Morningstar Direct with calculations by Envestnet | PMC. Tax Ratio data as of 6/30/2023. Expense Ratio data as of 7/27/2023.

2The ETF Institute

The information, analysis, and opinions expressed herein are for informational purposes only and represent the views of the speakers, not necessarily the views of Envestnet. The views expressed herein reflect the judgement of the writer and are subject to change at any time without notice. Information obtained from third party resources are believed to be reliable but not guaranteed. Any graphical information contained herein is for illustrative purposes only and not based on actual client data.

Exchange Traded Funds (ETFs) and mutual funds are subject to risks similar to those of stocks, such as market risk. Investing in ETFs may bear indirect fees and expenses charged by ETFs in addition to its direct fees and expenses, as well as indirectly bearing the principal risks of those ETFs. Income (bond) ETFs and mutual funds are subject to interest rate risk which is the risk that debt securities in a fund´s portfolio will decline in value because of increases in market interest rates.

Expense Ratios reflect the internal expenses of any investment products but do not reflect the deduction of investment advisory fees. Performance results will be reduced by fees including, but not limited to, investment management fees and other costs such as custodial, reporting, evaluation and advisory services. A description of all fees, costs and expenses are found in a financial advisor's Disclosure Brochure. Past performance is not indicative of future results.

Neither Envestnet, Envestnet | PMC™ nor its representatives render tax, accounting or legal advice. Any tax statements contained herein are not intended or written to be used, and cannot be used, for the purpose of avoiding U.S. federal, state, or local tax penalties. Taxpayers should always seek advice based on their own particular circumstances from an independent tax advisor.