Commentaries

The Nuts and Bolts of ETFs

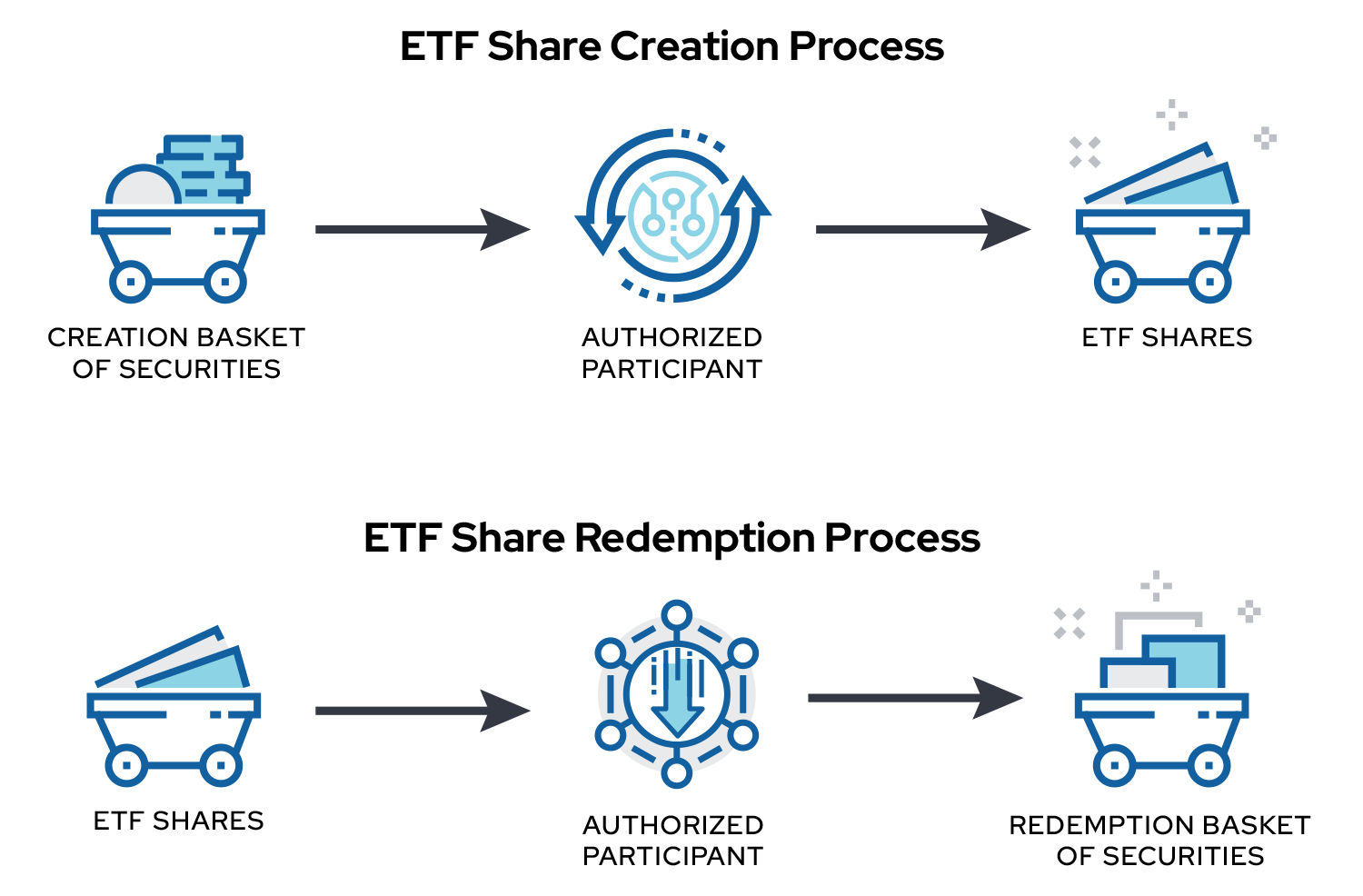

To best understand the features of ETFs, it’s important to explore how their shares are created and redeemed.

In the first post of this series, we investigated the potential advantages of ETFs and how they may benefit investors. In this article, we’re going to get a little nerdy as we examine the ETF structure and the innovative process behind ETF trading. Now you may be wondering, “Why should I care how this financial ‘sausage’ is made?” Well, we think you’ll be better able to consider ETFs for client portfolios once you’re familiar with their nuts and bolts. So, consider this post to be like a general ETF instruction manual. Time to buckle up!

The Crucial Role of Authorized Participants (APs)

Authorized Participants (commonly abbreviated “APs”) collectively represent an important cog in the ETF ecosystem, and they are typically large broker-dealers or market makers with large inventories of securities. The APs form agreements with an ETF sponsor (the company that creates the ETF and manages it) to convert baskets of securities into ETF shares or to break down ETF shares into their components: individual securities. The ETF sponsor designs the fund’s portfolio using various stocks, bonds, and derivatives, and the APs create or redeem ETF shares according to the sponsor’s blueprint.

A-Tisket, A-Tasket, An ETF Security Basket

When money is flowing into an ETF, creation baskets of securities are used to “manufacture” more ETF shares. If money funnels out of the ETF, the APs destroy shares of the fund by chopping them up into redemption baskets of securities. Investor demand for the ETF determines whether more of its shares are constructed or demolished. The security baskets can be thought of as ETF building blocks (or salvaged parts) in this process.

Why APs and Baskets Matter

Mutual fund shares are created when the fund company purchases securities and then sells shares in itself. The process is then reversed when a mutual fund investor wants to offload shares—some of the fund’s securities are sold in order to repurchase the investor’s shares of the fund. As we’ll explore in-depth with a future blog post, this method of mutual fund transactions can create tax bills for all of the fund’s investors when any of one investor’s shares are sold. The fund’s portfolio manager(s) may trigger even more taxable distributions for shareholders as the fund’s portfolio is adjusted. Do you really want to pay more in taxes just because I dumped shares in a fund? Do your clients?

ETFs generally can be much more tax-efficient than mutual funds due to the share creation and redemption mechanism with APs that’s described above. This same process enables intraday pricing and trading in ETFs, as described in our ETF 101 post. In short, the basic organization of an ETF directly enables its potential advantages.

Wrapping Up

Now that you have a better understanding of how ETFs function, you’ll be better prepared to evaluate them and discuss them with your clients. When you consider how an ETF’s potential key features flow from its fundamental structure, it’ll also help you to identify possible use cases for these products. Navigating the ever-widening range of available ETFs can be daunting, but all of these funds use APs and baskets of securities in transactions. There are certainly various flavors of ETFs—low-cost, market-cap-weighted products (beta), systematic, factor-based strategies (strategic beta), and active ETFs. Regardless of the ETF strategy, though, the nuts and bolts all work the same. While we’ve focused on the common denominators of ETFs in this article, we welcome your questions on other topics related to ETFs and their possible inclusion in portfolios! Thanks for reading!

The information, analysis, and opinions expressed herein are for informational purposes only and represent the views of the speakers, not necessarily the views of Envestnet. The views expressed herein reflect the judgement of the writer and are subject to change at any time without notice. Information obtained from third party resources are believed to be reliable but not guaranteed. Any graphical information contained herein is for illustrative purposes only and not based on actual client data.

Exchange Traded Funds (ETFs) and mutual funds are subject to risks similar to those of stocks, such as market risk. Investing in ETFs may bear indirect fees and expenses charged by ETFs in addition to its direct fees and expenses, as well as indirectly bearing the principal risks of those ETFs. Income (bond) ETFs and mutual funds are subject to interest rate risk which is the risk that debt securities in a fund´s portfolio will decline in value because of increases in market interest rates.

Neither Envestnet, Envestnet | PMC™ nor its representatives render tax, accounting or legal advice. Any tax statements contained herein are not intended or written to be used, and cannot be used, for the purpose of avoiding U.S. federal, state, or local tax penalties. Taxpayers should always seek advice based on their own particular circumstances from an independent tax advisor.