Commentaries

The Inflation Reduction Act Is Already Supercharging U.S. Investment in the Energy Transition

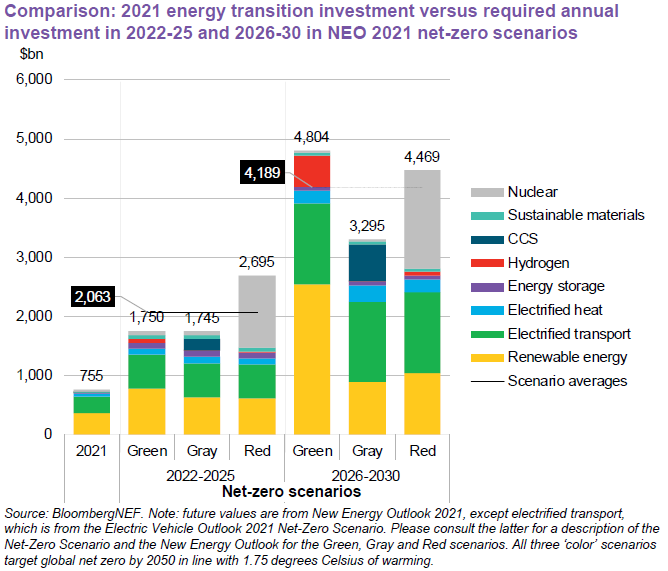

Given how embedded fossil fuels are in modern life, shifting the world’s energy production needs fully away from carbon-dioxide producing fuels like coal, oil, and fossil gas requires incremental investment of trillions of US dollars per year.1 In the United States, fossil fuel combustion is the primary source of energy for processes as diverse as electricity generation, transportation, industrial production, and home heating.2 The incumbency of polluting industries has predictably lent itself to state and regulatory capture, which in turn has delayed significant global climate action to the point that the ambitious goal of limiting global temperature rise to 1.5°C (2.7°F) above pre-industrial levels appears increasingly unattainable.3,4 The potentially tragic consequences of this failure of collective action include increasingly frequent and severe heat waves, droughts, wildfires, famine, and tropical cyclones, as well as sea level rise, ocean acidification, biodiversity loss, and pestilence. Taken together, these effects could arguably serve as our most lingering and ignominious bequest to future generations.5,6,7

1 https://about.bnef.com/energy-transition-investment/

2 https://flowcharts.llnl.gov/

3 https://www.opensecrets.org/news/2019/05/fossil-fuel-lobby-congress-on-climate-change/

4 https://www.economist.com/interactive/briefing/2022/11/05/the-world-is-going-to-miss-the-totemic-1-5c-climate-target

5 https://www.theguardian.com/environment/2016/aug/29/declare-anthropocene-epoch-experts-urge-geological-congress-human-impact-earth

6 https://climate.nasa.gov/effects/

7 https://www.brookings.edu/blog/order-from-chaos/2021/02/04/what-climate-change-will-mean-for-us-security-and-geopolitics/

The IRA represents historic spending on the most significant challenge the world faces this century.8

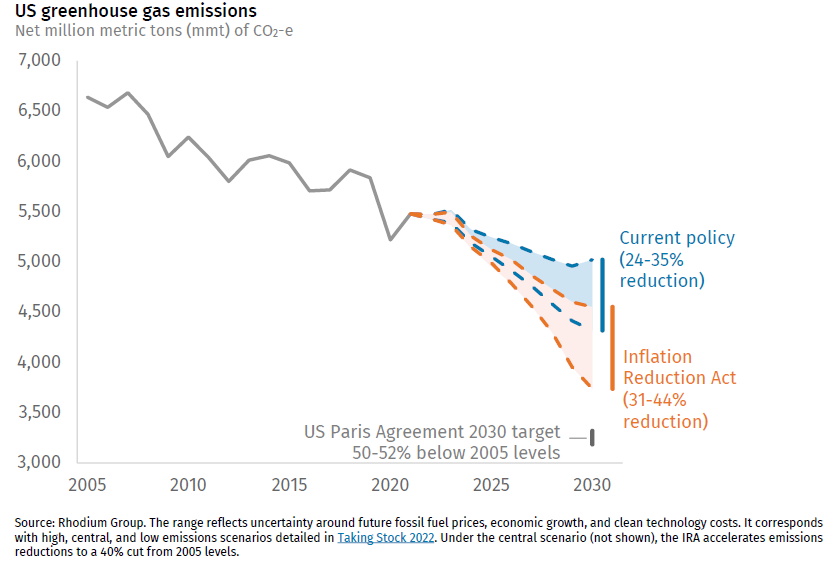

Against this discouraging backdrop, the Democrats’ recently enacted Inflation Reduction Act of 2022, which gives a new meaning to the acronym “IRA,” provides a powerful beam of hope that the United States, the world’s largest historical emitter of greenhouse gasses, can accelerate its transition to a decarbonized future while simultaneously supercharging domestic manufacturing.9 Despite falling short of the U.S.’ Paris Agreement target for emissions reductions by 2030, Rhodium Group estimates that the IRA significantly steepens the U.S.’ emissions trajectory, setting the economy on track to reduce emissions by 31 percent to 44 percent compared to 2005 levels, versus 24 percent to 35 percent projected under the prior policy regime.10

The sprawling legislation incorporates a diverse series of incentives focused on climate change mitigation and energy security, alongside other major provisions, such as a 15 percent minimum corporate tax, prescription drug pricing reform, and stepped-up IRS enforcement.11 The climate component, however, is the largest share of the bill and includes an estimated $369 billion in tax credits, standards, and grants – the single largest investment in clean transition in the country’s history.

8 https://rmi.org/climate-innovation-investment-and-industrial-policy/

9 https://ourworldindata.org/contributed-most-global-co2

10 https://rhg.com/research/inflation-reduction-act/

11 https://www.crfb.org/blogs/whats-inflation-reduction-act

Key IRA provisions enable a variety of new and emerging clean energy technologies

The IRA includes dozens of provisions to support clean energy production, adoption, and technology developments. While far from an exhaustive list, the following provisions are likely to be the most impactful in terms of decarbonization potential and ability to drive aggregate investment in the space.12,13

• Residential clean energy rebates and tax credits: a wide variety of income-dependent incentives for electrification of homes through efficient electric appliances, such as heat pumps, electric stoves, smart electrical panels, wiring upgrades, and other improvements. These incentives are expected to significantly drive down costs of building decarbonization.

• Extended and improved investment tax credits (ITCs) for solar and energy storage: the act extends a 30 percent tax credit for solar and storage projects through 2035, and for the first time, provides ITCs for standalone energy storage. These ITCs are expected to significantly accelerate investment in solar and storage across sectors and enable further grid flexibility through increased storage adoption.

• Extended production tax credits (PTCs) for wind, solar, geothermal, biomass, hydropower, and other renewable energy: the credit is calculated based on kilowatt-hours (kWh) produced and complements the ITCs to further drive down the cost of solar renewable generation.

• New electric vehicle (EV) tax credits and material sourcing requirements: the act created a new credit for used EVs and removed a cap on new vehicle tax credits, but requires vehicles to meet U.S. material sourcing requirements for critical minerals and battery components that ratchet up over time.

• New advanced manufacturing tax credits to spur domestic production of rare earth minerals, solar photovoltaics (PV), and other components and materials required for batteries and other clean energy technologies.

• Incentives for modular nuclear power production, alternative fuels, such as green hydrogen, biodiesel, and carbon capture.

The legislation is already having an impact on market dynamics and company investment

Domestic sourcing requirements across various aspects of the legislation limit availability of some credits in the near term and are expected to have a lag time for markets to see their full intended effect. However, this legislative bet seems to be paying off – capital investment is taking place in the U.S. to fully take advantage of the new regulatory environment for clean energy set by the IRA. First Solar, the largest U.S. solar manufacturer, announced that it will invest $1 billion to build a new factory in the U.S. and will be expanding production in Ohio.14 Enphase, a leading supplier of solar inverters, announced that it will start manufacturing these critical components in the U.S.15 Additionally, investment in U.S. EV battery manufacturing is increasing as well with commitments made by General Motors, Ford, LG Chem, and others.16

It is important to note that only a share of IRA’s incentives are tied to domestic sourcing requirements and that multiple clean energy technology manufacturers and service providers are expected to immediately benefit. For example, energy service companies that focus on building decarbonization through energy efficiency and distributed energy generation, such as solar, storage, and microgrids, are expected to see significantly improved project economics as a result of IRA’s extended ITCs and PTCs.17

12 https://www.woodmac.com/news/opinion/us-inflation-reduction-act-set-to-make-climate-history/

13 https://guidehouse.com/insights/energy/2022/accelerating-us-green-energy-and-sustainability-investments-ira

14 https://www.canarymedia.com/articles/solar/climate-law-incentives-prompt-first-solar-factory-expansion

15 https://www.canarymedia.com/articles/solar/enphase-to-manufacture-solar-inverters-in-us-spurred-by-new-tax-credits

16 https://www.eenews.net/articles/climate-law-spurs-big-jumps-in-u-s-battery-investments/

17 https://guidehouseinsights.com/news-and-views/the-iras-impact-on-building-efficiency-and-decarbonization-markets

Long-term effects are anticipated to accelerate the energy transition

The implications of these policies are significant and will reshape the political economy of clean energy and the transition away from fossil fuels.

• The law emphasizes domestic manufacturing and material sourcing over foreign sources and supply chains, therefore supporting U.S. manufacturing and clean energy jobs in the long-term. By focusing on domestic manufacturing and jobs, the IRA has accelerated investment in the energy transition in places not typically known for promoting action on climate change, which is likely to produce new constituencies for clean energy generation and related industrial development.18

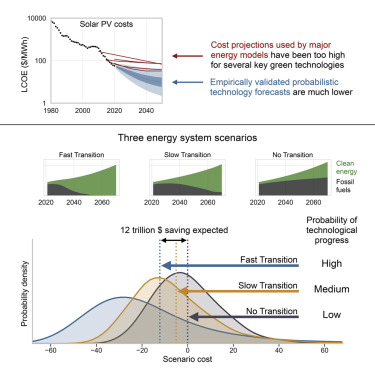

• The IRA bolsters project economics for current clean energy players active in the U.S. market by accelerating deployment of clean energy technologies. In contrast with fossil fuels, solar PV, wind turbines, batteries, and electrolyzers have historically exhibited exponential cost declines as capacity scales. Recent research has demonstrated that this is likely to result in substantially faster cost declines for these technologies than current integrated IPCC assessment models show19 This legislation will likely make these technologies even more competitive versus legacy fossil fuel solutions.

• The IRA provides policy certainty for investors, which reduces risks for individual companies and accelerates capital investment. The federal government’s significantly increased willingness to share risks with the private sector is already speeding the transition.20,21

• The electrification of the economy will reduce inflationary pressures associated with volatile fossil fuel supply chains and reduce long-term demand for hydrocarbons.22,23

The IRA as a confidence generator

Many hurdles remain for the U.S. economy and its consumers to fully avail themselves of the decarbonization incentives in these bills (e.g., permitting hurdles for power transmission and mining).24 As a result, the developments of the past year represent a starting point rather than a “mission accomplished” moment. While future implementation hurdles shouldn’t be dismissed, it would be a mistake to underrate the tectonic shift that has recently occurred in the way businesses are incentivized to think about the energy transition. As Credit Suisse analysts explain in a recent note, the IRA “definitively changes the narrative from risk mitigation to opportunity capture.”25 In the same note, Credit Suisse highlights how the uncapped nature of certain tax credits could lead to federal IRA spending of more than double what the Congressional Budget Office initially projected. Regardless of the exact level of spending stemming from the IRA, however, investment in the energy transition has become the “safe, smart, government-backed bet for conservative investors.” The energy landscape was already shifting prior to the passage of the IRA and other major industrial policy bills during this Congress, but investors should take note of how recent legislation has fundamentally accelerated these macro trends.

18 https://www.bloomberg.com/opinion/features/2022-08-02/us-green-energy-budgets-pushed-by-democrats-get-spent-on-republicans

19 https://www.cell.com/joule/fulltext/S2542-4351(22)00410-X

20 https://www.bain.com/insights/decarbonization-game-changer/

21 https://www.utilitydive.com/news/venture-capital-solar-energy-storage-mercom-report/634449/

22 https://www.vox.com/science-and-health/2022/8/12/23290488/fight-climate-change-end-fossil-fuel-inflation

23 https://www.eenews.net/articles/climate-law-seen-driving-demand-destruction-for-fossil-fuels/

24 https://rmi.org/the-best-time-to-plan-transmission-was-15-years-ago-the-second-best-time-is-now/

25 https://www.theatlantic.com/science/archive/2022/10/inflation-reduction-act-climate-economy/671659/

The information, analysis, and opinions expressed herein are for general and educational purposes only. Nothing contained in this brochure is intended to constitute legal, tax, accounting, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type. All investments carry a certain risk, and there is no assurance that an investment will provide positive performance over any period of time. An investor may experience loss of principal. The asset classes and/or investment strategies described may not be suitable for all investors and investors should consult with an investment advisor to determine the appropriate investment strategy. Investment decisions should always be made based on the investor’s specific financial needs and objectives, goals, time horizon and risk tolerance. Past performance is not indicative of future results. This material is not meant as a recommendation or endorsement of any specific security or strategy. Information has been obtained from sources believed to be reliable, however, Envestnet | PMC cannot guarantee the accuracy of the information provided. The information, analysis and opinions expressed herein reflect our judgment as of the date of writing and are subject to change at any time without notice. An individual’s situation may vary; therefore, the information provided above should be relied upon only when coordinated with individual professional advice. Reliance upon any information is at the individual’s sole discretion. Diversification does not guarantee profit or protect against loss in declining markets.

FOR INVESTMENT PROFESSIONAL USE ONLY ©2022 Envestnet. All rights reserved.