Commentaries

PMC Market Commentary: October 24, 2014

A Macro View – Mid-Term Election Years and Small Cap Underperformance

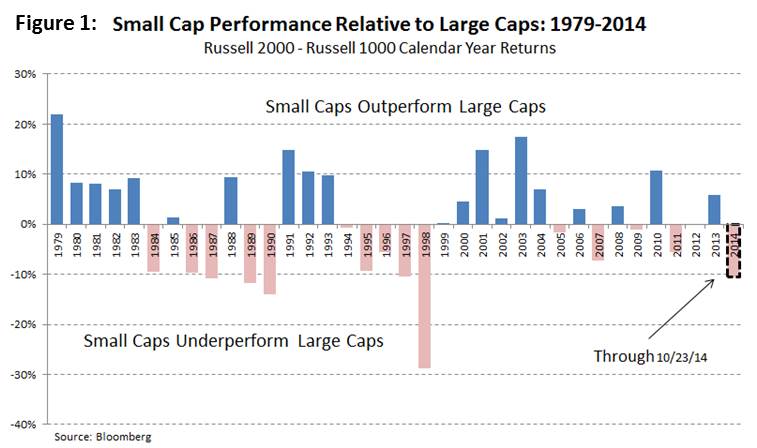

Much has been made of the poor performance of small caps relative to large caps this year. The Russell 2000 Index of small cap stocks has underperformed the Russell 1000 Index of large cap stocks by 10.6% (~1060 basis points) on a year-to-date basis through 10/23/14. A significant amount, to be sure, and the year is not yet over. Historically, the average small cap underperformance has been 8.6%.

However, while the underperformance of small caps has hurt portfolios with an overweight to the asset class, the underperformance typically occurs in years when the overall market’s performance is positive. Only once (in 1990) in the past 34 years have small caps underperformed when the S&P 500 declined for the year.

However, while the underperformance of small caps has hurt portfolios with an overweight to the asset class, the underperformance typically occurs in years when the overall market’s performance is positive. Only once (in 1990) in the past 34 years have small caps underperformed when the S&P 500 declined for the year.

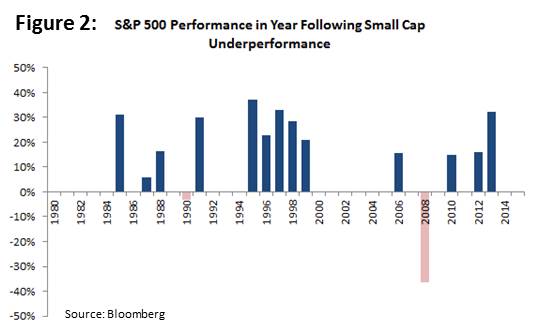

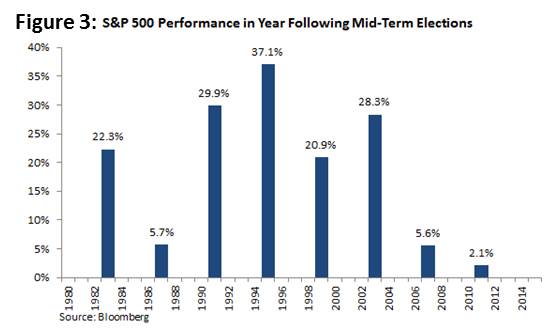

More interesting to us is analyzing what happens in the years following the underperformance by small caps. Since 1979, small caps have underperformed 15 times (not including 2014) (Figure 1). In the year following that underperformance, the S&P 500 has risen 13 times, with an average total return of +17.6% (Figure 2). An additional dimension in the analysis is the fact that this is a mid-term election year. Encouragingly, in the past 34 years, irrespective of the party in power, the S&P 500 has posted a positive return in the year following a mid-term election every time, with an average gain of 19.0% (Figure 3).

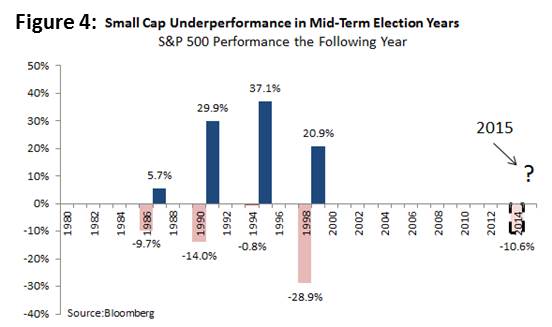

Combining the small cap underperformance and mid-term election year effects, we find that small caps have underperformed in mid-term election years four times since 1979. In each instance, the S&P 500 has risen the following year, generating an average return of 23.4% (Figure 4).

While only time will tell what may happen in 2015, history indicates the market could potentially enjoy a favorable year.

The information, analysis, and opinions expressed herein are for general and educational purposes only. Nothing contained in this weekly review is intended to constitute legal, tax, accounting, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type. All investments carry a certain risk, and there is no assurance that an investment will provide positive performance over any period of time. An investor may experience loss of principal. Investment decisions should always be made based on the investor’s specific financial needs and objectives, goals, time horizon, and risk tolerance. The asset classes and/or investment strategies described may not be suitable for all investors and investors should consult with an investment advisor to determine the appropriate investment strategy. Past performance is not indicative of future results.

Information obtained from third party sources are believed to be reliable but not guaranteed. Envestnet|PMC™ makes no representation regarding the accuracy or completeness of information provided herein. All opinions and views constitute our judgments as of the date of writing and are subject to change at any time without notice.

Investments in smaller companies carry greater risk than is customarily associated with larger companies for various reasons such as volatility of earnings and prospects, higher failure rates, and limited markets, product lines or financial resources. Investing overseas involves special risks, including the volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. Income (bond) securities are subject to interest rate risk, which is the risk that debt securities in a portfolio will decline in value because of increases in market interest rates. Exchange Traded Funds (ETFs) are subject to risks similar to those of stocks, such as market risk. Investing in ETFs may bear indirect fees and expenses charged by ETFs in addition to its direct fees and expenses, as well as indirectly bearing the principal risks of those ETFs. ETFs may trade at a discount to their net asset value and are subject to the market fluctuations of their underlying investments. Investing in commodities can be volatile and can suffer from periods of prolonged decline in value and may not be suitable for all investors. Index Performance is presented for illustrative purposes only and does not represent the performance of any specific investment product or portfolio. An investment cannot be made directly into an index.

Alternative Investments may have complex terms and features that are not easily understood and are not suitable for all investors. You should conduct your own due diligence to ensure you understand the features of the product before investing. Alternative investment strategies may employ a variety of hedging techniques and non-traditional instruments such as inverse and leveraged products. Certain hedging techniques include matched combinations that neutralize or offset individual risks such as merger arbitrage, long/short equity, convertible bond arbitrage and fixed-income arbitrage. Leveraged products are those that employ financial derivatives and debt to try to achieve a multiple (for example two or three times) of the return or inverse return of a stated index or benchmark over the course of a single day. Inverse products utilize short selling, derivatives trading, and other leveraged investment techniques, such as futures trading to achieve their objectives, mainly to track the inverse of their benchmarks. As with all investments, there is no assurance that any investment strategies will achieve their objectives or protect against losses.

Neither Envestnet, Envestnet|PMC™ nor its representatives render tax, accounting or legal advice. Any tax statements contained herein are not intended or written to be used, and cannot be used, for the purpose of avoiding U.S. federal, state, or local tax penalties. Taxpayers should always seek advice based on their own particular circumstances from an independent tax advisor.

© 2014 Envestnet. All rights reserved.