Commentaries

Trends We’re Tracking: U.S. Dollar, Recession Risk, and Single-Stock ETFs

Envestnet | PMC provides independent advisors, broker-dealers, and institutional investors with comprehensive manager research, portfolio consulting, and portfolio management to help improve client outcomes. Every month our Global Macro Team offers insights into the themes currently shaping the markets to help you quickly take note of recent trends that your clients may be inquiring about.

The good and the bad of a strong greenback

The U.S. dollar broke new records last month, trading above parity with the Euro for the first time since 2002 and reaching a 20-year high against the Japanese Yen. Backed by the Fed’s determination to tame inflation through hiking interest rates, the strong dollar has several consequences - both good and bad - as strong purchasing power for overseas travel is countered by emerging market debt woes and reduced corporate earnings. Read our deeper analysis of this situation here.

Inflation and rising rents resulting in high pet abandonment rates

Rising pet abandonment rates is a clear indicator that high inflation and rents have started to deeply impact the lives of average Americans as they are forced to make difficult choices when it comes to their pets. While a 41-year high inflation has resulted in higher pet care costs, higher rents have also forced people to move to cheaper, less pet-friendly accommodations. Animal Care Centers are seeing an increase in people surrendering their pets in the first half of 2022. The number of owners surrendering their pets was up 25 percent compared to the same time last year. Fewer adoptions combined with higher abandonment rates are making animal lovers worry about euthanasia due to overcrowding of shelters.1,2,3

The International Monetary Fund updates global growth projections for 2022 and 2023

The International Monetary Fund (IMF) has revised its World Economic Outlook for the third time this year. The July report has global growth projections tumbling from an estimated 6.1 percent in 2021 to 3.2 percent in 2022 and 2.9 percent in 2023. The new growth projection for 2022 comes in 0.4 percentage points lower than the April World Economic Outlook. The recent estimates are results of global production contracting in the second quarter caused by downturns in China and Russia and U.S. consumer spending undershooting expectations. In addition, higher-than-expected inflation and monetary policies continue to shock the world economy creating gloomy outlooks for the remainder of the year and into 2023.4

Big profits for big oil

During the second quarter, ExxonMobil and Chevron set profit records as energy prices soared after the Russian invasion of Ukraine. Exxon had a net profit of $17.9 B, which beat their previous best quarter in 2012 of $15.9 B. Chevron had a net profit of $11.6 B, easily beating consensus analyst estimates of $9.9 B. The largest western oil players (Exxon, Chevron, Shell, BP, and TotalEnergies) have generated over $50 B in profits in the three months leading up to the end of June.5

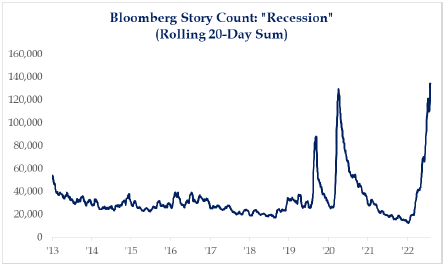

Two quarters of negative GDP don’t always make a recession

Even before the U.S. Bureau of Economic Analysis released preliminary figures on July 28 showing that real gross domestic product contracted 0.23% for Q2, “recession” was on many commenters’ lips. In fact, Bloomberg’s story count shows the number of stories mentioning the word have surpassed the level at the very start of the COVID-19 pandemic.6 Persistent inflation, rising geopolitical tensions, and tightening monetary conditions have all contributed to a dour outlook for most developed economies, but even as the U.S. posted its second consecutive quarter of negative real growth, it is too early to announce a recession. An obscure fact relevant to this debate is that the National Bureau of Economic Research’s Business Cycle Dating Committee is the official arbiter of U.S. recessions, which they define as “a significant decline in economic activity that is spread across the economy and lasts more than a few months.” The Committee considers its three criteria - depth, diffusion, and duration - “interchangeably,” noting that an outsized assessment of one or two of these criteria can offset a weak argument from another.7 The most recent example of this is February 2020, when the intense depth and diffusion of the economic fallout from COVID-19 outweighed the short duration of the contraction. In the future, we may learn that our current moment fell within the bounds of a recession, but we’ll have to wait for the Committee’s verdict.

(via Strategas Daily Macro Brief 8/3/2022)

Era of single-stock ETFs has begun

On July 14, AXS Investments launched eight first ever single-stock ETFs in the U.S. that are tied to stocks of five well-known companies (Tesla, Nvidia, PayPal, Nike and Pfizer). While leveraged and inversed ETFs has been existing for years, in the past they were all tied to a basket of stocks like sectors or broad equity market indices. These eight new ETFs, however, are tied to a single stock. For example, TSLQ (AXS TSLA Bear Daily ETF) seeks performance that corresponds to the inverse of TSLA, the stock of Tesla, essentially shorting the stock.8,9

Since leveraged and inversed ETFs can be highly speculative and misunderstood/misused by unsophisticated investors, many market observers urge caution towards these new single-stock ETFs and regulators like the SEC vow to keep close scrutiny on them. On the other hand, if managed appropriately, they can be useful vehicles for retail investors to utilize to perform risk management like hedging or tax management. With derivatives still out of reach for most retail investors, they can be a cost-effective alternative which may help further democratize investing for retail investors.

Sources:

1. Emma Ockerman, “‘They’ve owned these pets for years’: People are giving up family dogs they adopted long before the pandemic, mostly due to inflation, shelters say,” MarketWatch, July 18, 2022, https://www.marketwatch.com/story/theyve-owned-these-pets-for-years-people-are-giving-up-family-dogs-they-adopted-long-before-the-pandemic-mostly-due-to-inflation-shelters-say-11657559789

2. Cortney Moore, “Families are returning pets to shelters due to inflation, rising rents,” NYPost.com, July 19, 2022, https://nypost.com/2022/07/19/families-are-returning-pets-to-shelters-due-to-inflation-rising-rents/

3. Amira Sweilem and Finch Walker, “Pets are being given up as owners struggle to pay bills,” Associated Press, July 3, 2022, https://www.usnews.com/news/best-states/florida/articles/2022-07-03/pets-are-being-given-up-as-owners-struggle-to-pay-bills

4. “World Economic Outlook Update, July 2022,” IMF.org, https://www.imf.org/en/Publications/WEO/Issues/2022/07/26/world-economic-outlook-update-july-2022

5. Justin Jacobs, “ExxonMobil and Chevron shatter profit records after global oil price surge,” The Financial Times, July 29, 2022, https://www.ft.com/content/13f82093-1110-4c92-9fea-936067a5f29e

6. Strategas Daily Macro Brief 8/3/2022, https://www.strategasrp.com/

7. National Bureau of Economic Research, Business Cycle Dating https://www.nber.org/research/business-cycle-dating

8. Katie Greifeld and Elaine Chen, “Wall Street Set for New ETF Gold Rush as Single-Stock Era Begins,” Bloomberg News, July 16, 2022, https://www.bloomberg.com/news/articles/2022-07-16/wall-street-set-for-new-etf-gold-rush-as-single-stock-era-begins

9. AXS Investments press release, “AXS Investments Launches First Ever U.S. Suite of Single-Stock Leveraged Bull and Bear ETFs,” July 14, 2022

The information, analysis, and opinions expressed herein are for general and educational purposes only. Nothing contained in this brochure is intended to constitute legal, tax, accounting, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type. All investments carry a certain risk, and there is no assurance that an investment will provide positive performance over any period of time. An investor may experience loss of principal. The asset classes and/or investment strategies described may not be suitable for all investors and investors should consult with an investment advisor to determine the appropriate investment strategy. Investment decisions should always be made based on the investor’s specific financial needs and objectives, goals, time horizon and risk tolerance. Past performance is not indicative of future results. This material is not meant as a recommendation or endorsement of any specific security or strategy. Information has been obtained from sources believed to be reliable, however, Envestnet | PMC cannot guarantee the accuracy of the information provided. The information, analysis and opinions expressed herein reflect our judgment as of the date of writing and are subject to change at any time without notice. An individual’s situation may vary; therefore, the information provided above should be relied upon only when coordinated with individual professional advice. Reliance upon any information is at the individual’s sole discretion. Diversification does not guarantee profit or protect against loss in declining markets.

Exchange Traded Funds (ETFs) and mutual funds are subject to risks similar to those of stocks, such as market risk. Investing in ETFs may bear indirect fees and expenses charged by ETFs in addition to its direct fees and expenses, as well as indirectly bearing the principal risks of those ETFs. Income (bond) ETFs and mutual funds are subject to interest rate risk which is the risk that debt securities in a fund’s portfolio will decline in value because of increases in market interest rates.

FOR INVESTMENT PROFESSIONAL USE ONLY ©2022 Envestnet. All rights reserved.