Commentaries

Active ETFs Are Gathering Steam. What Are They, Anyway?

When most people think of Exchange-Traded Funds (ETFs), their minds turn to passively managed products. The growth of active ETFs is changing the landscape, though.

In the U.S., many individual investors use mutual funds to access actively managed investment strategies designed to (potentially) outperform benchmarks. High net worth investors may also use separately accounts (SMAs) and hedge funds to tap the skills of talented portfolio managers. ETFs, meanwhile, have historically tracked passively managed indices (traditional beta) or, more recently, followed smart beta strategies. (Smart beta products utilize quantitative methods in an attempt to isolate stocks or other securities with certain characteristics—these characteristics are often termed “factors.” Common factors include Value, Momentum, Quality, Size, and Carry.) More recently, actively managed ETFs have been gaining popularity, so let’s explore this innovative category of fund.

Active ETFs Explained

Active ETFs are managed by investment teams seeking to outperform their benchmarks, just like active mutual funds. The only difference is the “wrapper” used to enable investor access to the managed portfolio underlying the fund. In fact, the same investment strategy can often be offered as either a mutual fund or ETF. As we discussed in our ETF 101 article, the ETF structure offers features that may benefit investors, including potential tax savings and greater trading flexibility. Some actively managed mutual funds are even being converted into ETFs to offer investors a fresh way to access an experienced fund management team.

Because active ETFs generally require significant research processes, expensive data feeds, and specialized analysts/portfolio managers, they typically charge greater fees than index funds. (Fees vary widely across the active ETF universe, though.) So, the possibility of a fund outperforming its benchmark generally comes at the price of a higher expense ratio. As always, we encourage investors and their advisors to know what they’re paying for when selecting any type of fund.

Active ETFs Are Gathering AUM

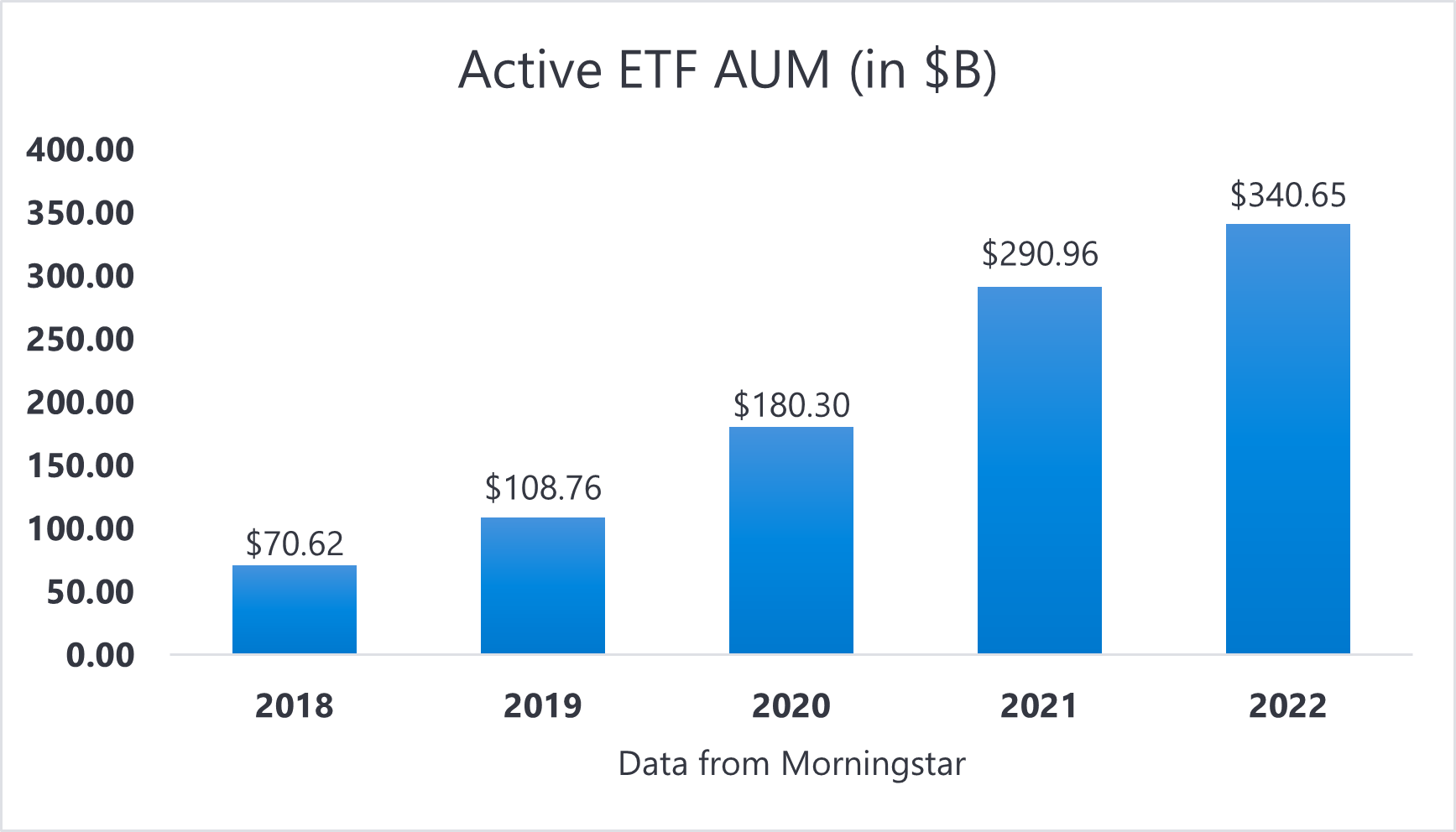

Now that we’ve discussed the fundamentals of active ETFs, you may be wondering, “Just how popular are these products?” Great question! At the end of 2022, active ETF AUM (assets under management) totaled almost $341 billion.1 Still, that figure is equivalent to just under 5.6% of the $6.1 trillion invested in traditional passive ETFs.2 An examination of growth rates, however, illustrates the burgeoning demand for active ETFs.

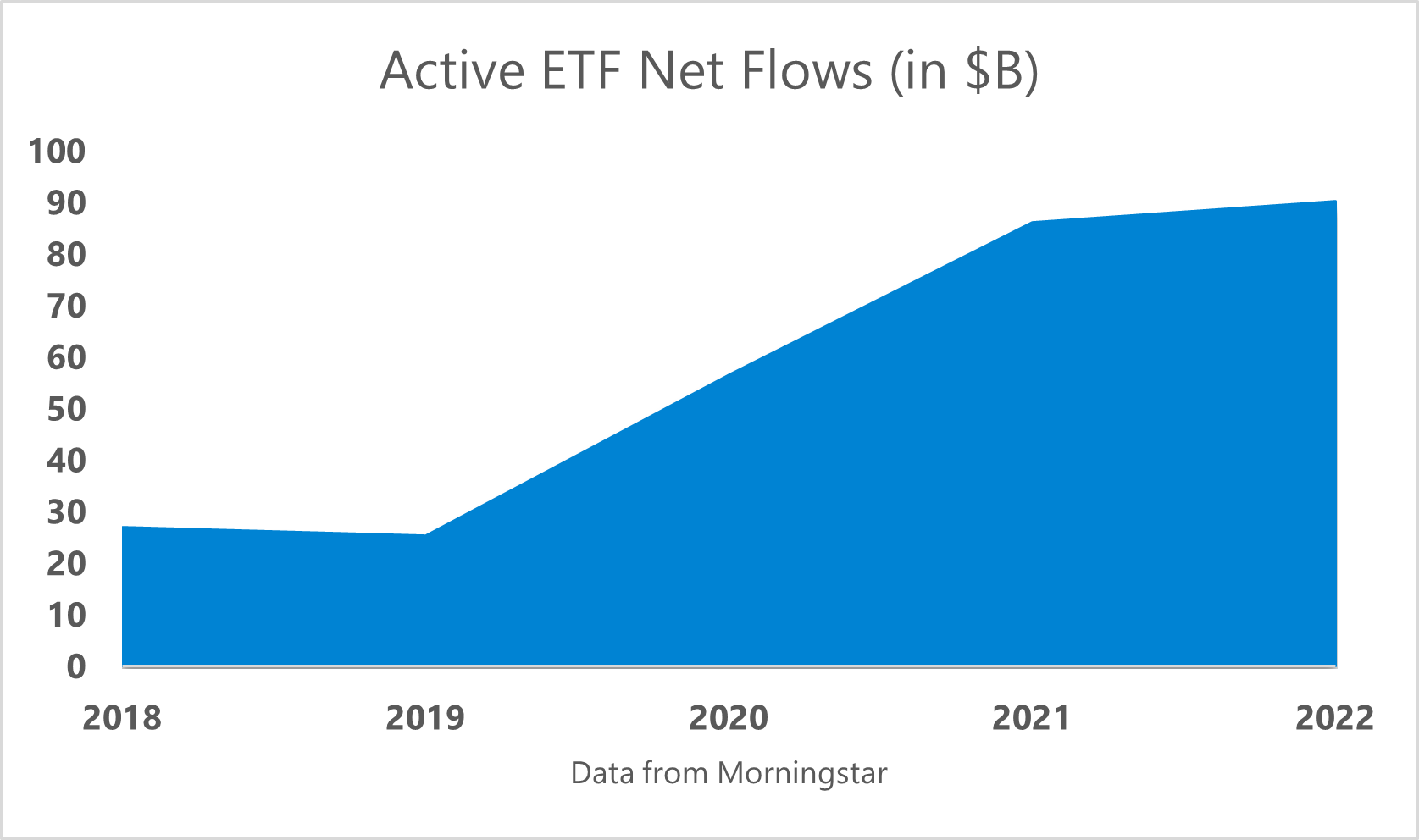

In 2022, active ETFs enjoyed a collective 31% organic growth rate, while traditional passive ETFs grew around 7%.3 As you’ll see in the chart below, annual net flows into active ETFs have been climbing, too. In fact, active ETF net flows were 235% higher in 2022 than in 2018—that’s strong growth indeed.

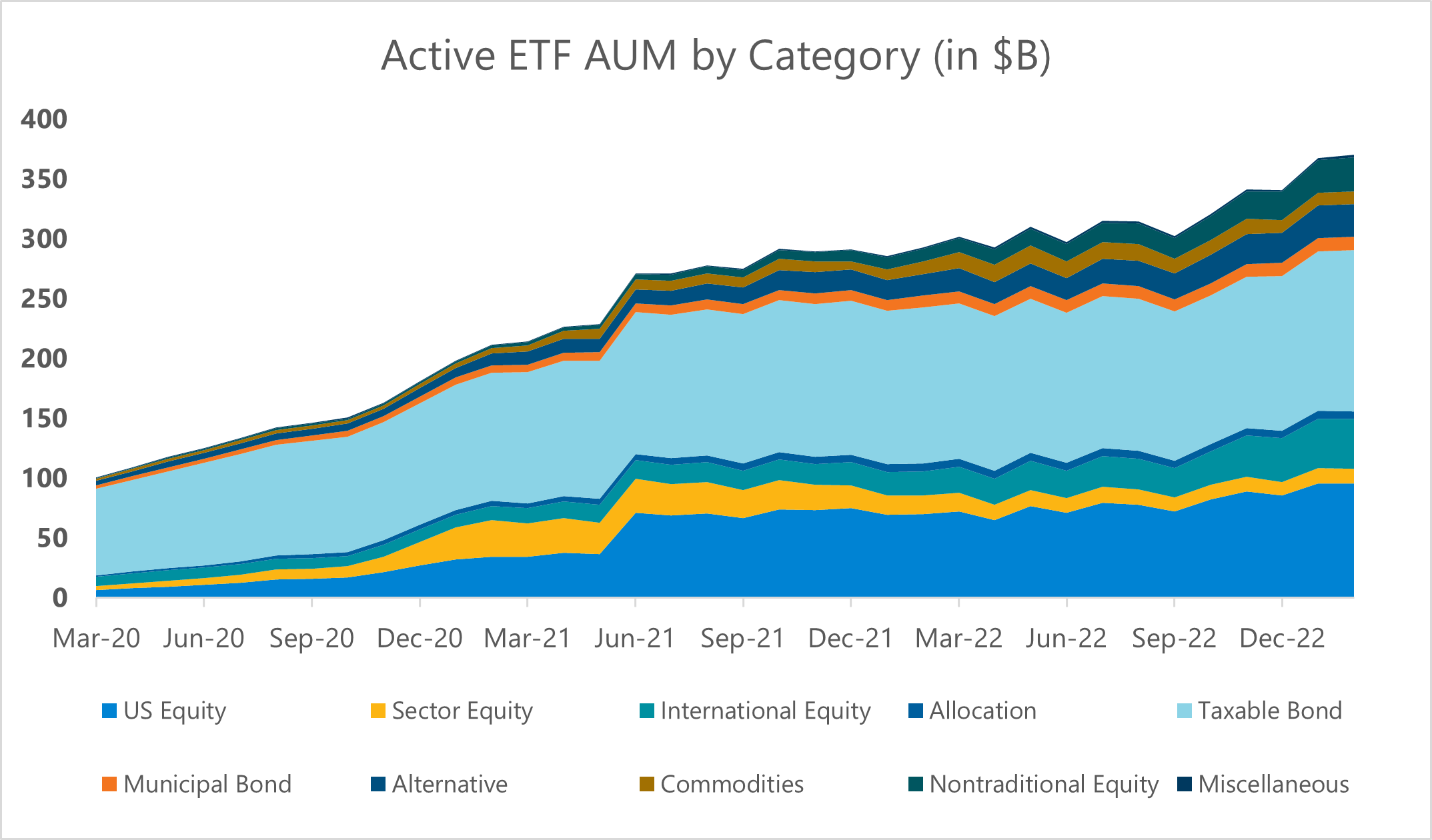

The money flowing into active ETFs has led to the creation of a wide range of these funds across asset classes. As the breadth of the active ETF universe increases, investors and their advisors can access funds to meet a wide array of needs. We continue to see fresh active ETF launches every few weeks, too, so there’s no shortage of new strategies to evaluate. Asset managers are responding to the demand for these products, especially as the active mutual fund category sees persistent outflows and limited innovation.

Data from Morningstar

Wrapping Up and Looking Ahead

Active ETFs combine the potential benefits of active management with the features of the ETF structure—in a way, they merge the old and the new in a single category. While these funds don’t yet dominate the marketplace, this type of ETF is seeing strong demand and a wave of unique product offerings. These trends are also unlikely to abate anytime soon, illustrating the importance of active ETF fluency. We hope you’ve enjoyed exploring the active ETF realm and, as always, we welcome your questions on ETFs or other investment topics. In our next post for this series, we’ll investigate the tax efficiency of active ETFs, especially when compared with active mutual funds. We look forward to sharing our research with you!

Sources:

1 Data from Morningstar Direct

2 Data from Morningstar Direct, excludes leveraged and inverse ETFs

3 Data from Morningstar Direct

The information, analysis, and opinions expressed herein are for informational purposes only and represent the views of the speakers, not necessarily the views of Envestnet. The views expressed herein reflect the judgement of the writer and are subject to change at any time without notice. Information obtained from third party resources are believed to be reliable but not guaranteed. Any graphical information contained herein is for illustrative purposes only and not based on actual client data.

Exchange Traded Funds (ETFs) and mutual funds are subject to risks similar to those of stocks, such as market risk. Investing in ETFs may bear indirect fees and expenses charged by ETFs in addition to its direct fees and expenses, as well as indirectly bearing the principal risks of those ETFs. Income (bond) ETFs and mutual funds are subject to interest rate risk which is the risk that debt securities in a fund´s portfolio will decline in value because of increases in market interest rates.

Neither Envestnet, Envestnet | PMC™ nor its representatives render tax, accounting or legal advice. Any tax statements contained herein are not intended or written to be used, and cannot be used, for the purpose of avoiding U.S. federal, state, or local tax penalties. Taxpayers should always seek advice based on their own particular circumstances from an independent tax advisor.